Outlook forUK Property 2019

Tuesday, 15 January 2019, Allen & Overy, One Bishops Square, London, E1 6AD

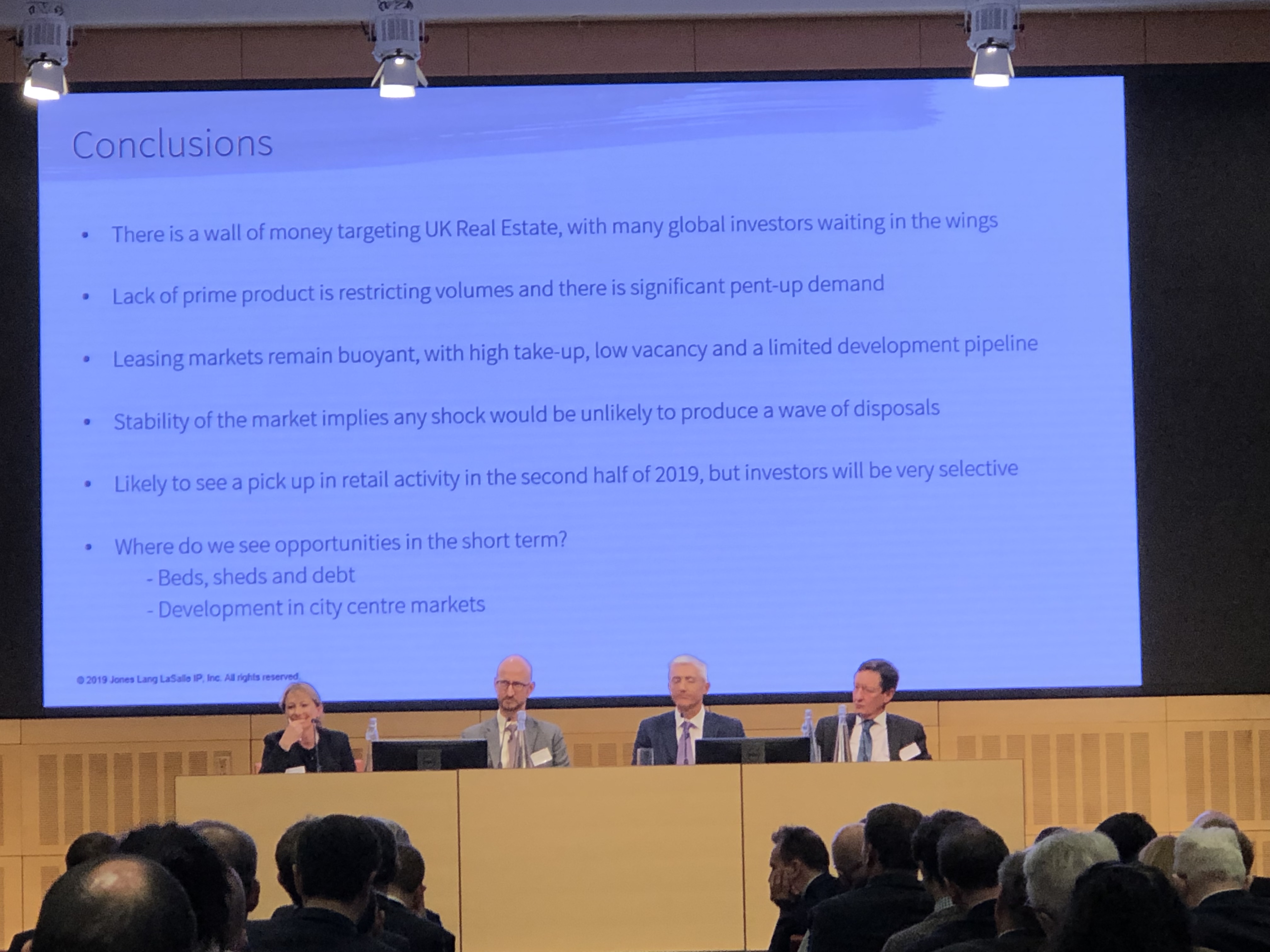

UK property to remain attractive in 2019

Although this event took place at the same time as MPs were passing through the Westminster lobbies to demolish Theresa May’s Brexit deal, the speakers were overwhelmingly positive that UK real estate would continue to attract substantial levels of investment in 2019.

Chris Ireland, UK Chief Executive at JLL proposed that money going into UK real estate in 2019 would rival the figure of £60 billion seen in 2018, even if further Brexit tribulations could mean that investment is more subdued in the first half of the year. Over the longer term, UK property would continue to be in demand from overseas investors, particularly as rental growth takes hold – at the top end of the sector spectrum, JLL predicts that prime South East industrial rents will rise by 20% over the next three years. Positive leasing trends should also continue in the major office markets, building on the strong take-up levels seen in both London and regional centres through 2018. And even in retail, pockets of value may begin to emerge towards the end of the year.

Ireland also proposed that the recent convergence of yields between the sectors could reverse in 2019. Asked to expand on this by moderator Helen Gordon, CEO of Grainger, he thought that in the short-term retail yields would move out relative to industrials – this was reflected in the IPF consensus forecasts of total returns for the year: around zero for retail, 9% for industrial, 4% for offices and 6-7% for alternative sectors.

UK real estate should stay attractive to domestic pension funds, suggested Simon Pilcher, Chief Executive for Fixed Income at M&G, including those supporting defined benefit (DB) schemes. Taking the example of long income funds, he noted that such real estate investments remained favourably priced compared to government and corporate bonds, even if the asset class may now be seen as highly priced relative to its own long-run averages. Of course, much depends on how bond yields are likely to change, but he stressed these have proved notoriously difficult to forecast in the past. And potential returns from UK real estate also look attractive to many foreign investors – particularly those from Asia – against the levels promised by their own markets.

Given the near-term uncertainties surrounding Brexit, Paul Guest, Lead Real Estate Strategist at UBS Asset Management directed his comments more towards longer-term prospects, where he sees UK economic growth returning to its long-run average around 2% p.a. in real terms over the next three years Nevertheless, this is likely to be held back by the negative effect of Brexit on fixed capital formation, which will affect future growth potential, even if this is being offset by private consumption – which has been holding up relatively well, based on a strong labour market and the lowest unemployment for a generation. UK real estate should thus be underpinned by a rate of growth that compares favourably with most other G7 markets, and London’s economy looks set to lead the UK regions once again in 2019.

Tim Horsey