Outlook for UK Property 2020

14th January 2020, Allen & Overy, One Bishops Square, London E1

Accentuating the positive

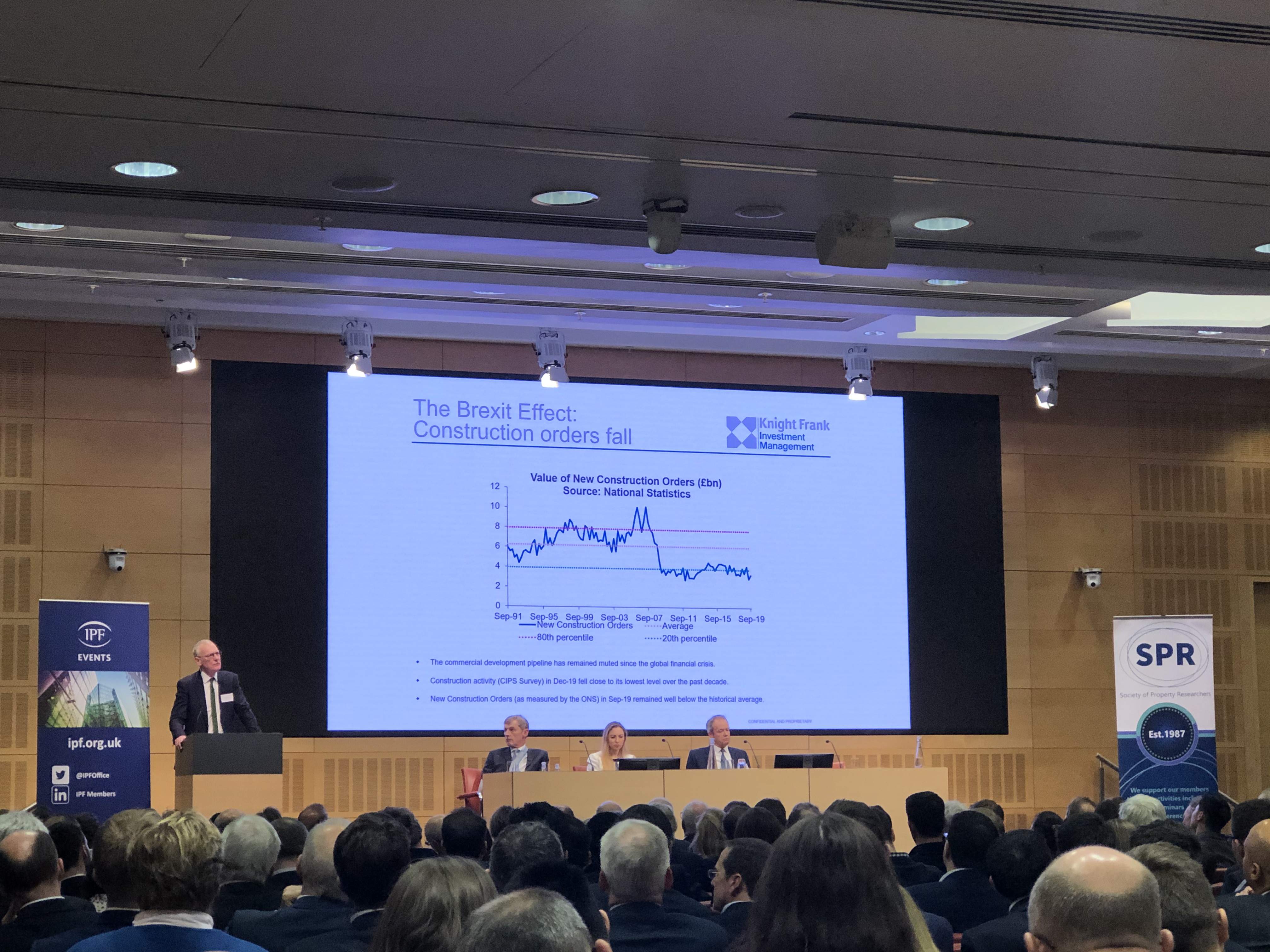

After the turmoil of 2019, 2020 should see UK commercial property returning to calmer waters. Speaking at this annual flagship event, Ian Whittock, CIO, Knight Frank Investment Management suggested that Brexit uncertainty had caused the UK investment market to stall over the last four years, but that yields are now attractive relative to those elsewhere in Europe, which should stand the market in good stead. Knight Frank IM saw a pick-up in investment in the last quarter of 2019, particularly from overseas, and he expected this to continue into 2020.

Whittock did however stress that it would not be plain sailing for all UK sectors. On the plus side, in his view London City offices are now attractively priced and should also see rental growth given their low level of vacancy, while the logistics market looks relatively ‘well balanced’. But retail remains problematic, with any light at the end of the tunnel at least two years away. He suggested that retail valuations are still excessive compared to anything that can be achieved in the market, even for the most ‘prime’ assets. Overall he expected that UK direct property would record a return around 5.5% in 2020.

Examining prospects for UK and European listed property, Marcus Phayre-Mudge, Fund Manager, BMO Global Asset Management largely echoed these sentiments, although he stressed that many UK real estate equities had already seen a rapid bounce back ‘after the summer holidays’ in 2019, when the prospects of a Brexit deal became much more positive. Aside from this return of confidence, Phayre-Mudge emphasised the strong market fundamentals underpinning most stocks: with the exception of non-food retail, this was based on solid rental growth prospects supported by strong tenant demand, while supply has been constrained by a lack of development over many years.

Framing the whole discussion was the comment by Liz Martins, UK Economist, HSBC, who opened the event, that 2020 should be a year of ‘less politics and more economics’. Still, immediate growth prospects appear relatively weak, at least based on commentary from the Bank of England that presages a near-term cut in interest rates. May is the date that currently figures in HSBC models, though many expect it to be much sooner. The UK has seen three years of subdued business investment and labour markets are losing momentum. However, Martins proposed that the new government’s promise to end austerity, boosting expenditure by some 3% based on its manifesto, should significantly add to demand in the longer run.

The impact of changes to fiscal policy were discussed further in the audience Q&A led by Alistair Elliott, Senior Partner & Group Chairman, Knight Frank, who chaired the meeting. Phayre-Mudge suggested that it would take 18 months for the pump to be primed and the economic effects to start coming through. All agreed that environmental considerations would be key in 2020: Whittock proposed that more sustainable building regulations could push up construction costs, but that the demand for more sustainable stock should increase.

Asked where they would invest £100m in real estate tomorrow, answers ranged from City of London offices (Whittock) to student housing in the UK, Netherlands, Belgium and Spain (Phayre-Mudge) and infrastructure in Eastern Europe (Martins). Finally, all agreed that the HS2 project should be allowed to go ahead.

Tim Horsey