SPR Seminar: Grid capacity

Tuesday 14th March, Knight Frank, London W1

On the road towards a low carbon future, headlines often focus on either the consumption or production of electricity, but far less attention is typically paid to the grid that connects them together. However, as Marija Simpraga of LGIM Real Assets, one of the two panellists at this SPR seminar explained, issues relating to the UK National Grid are having big implications for energy supplies reaching consumers – both business and private – over the next few years, and by extension for real estate investors.

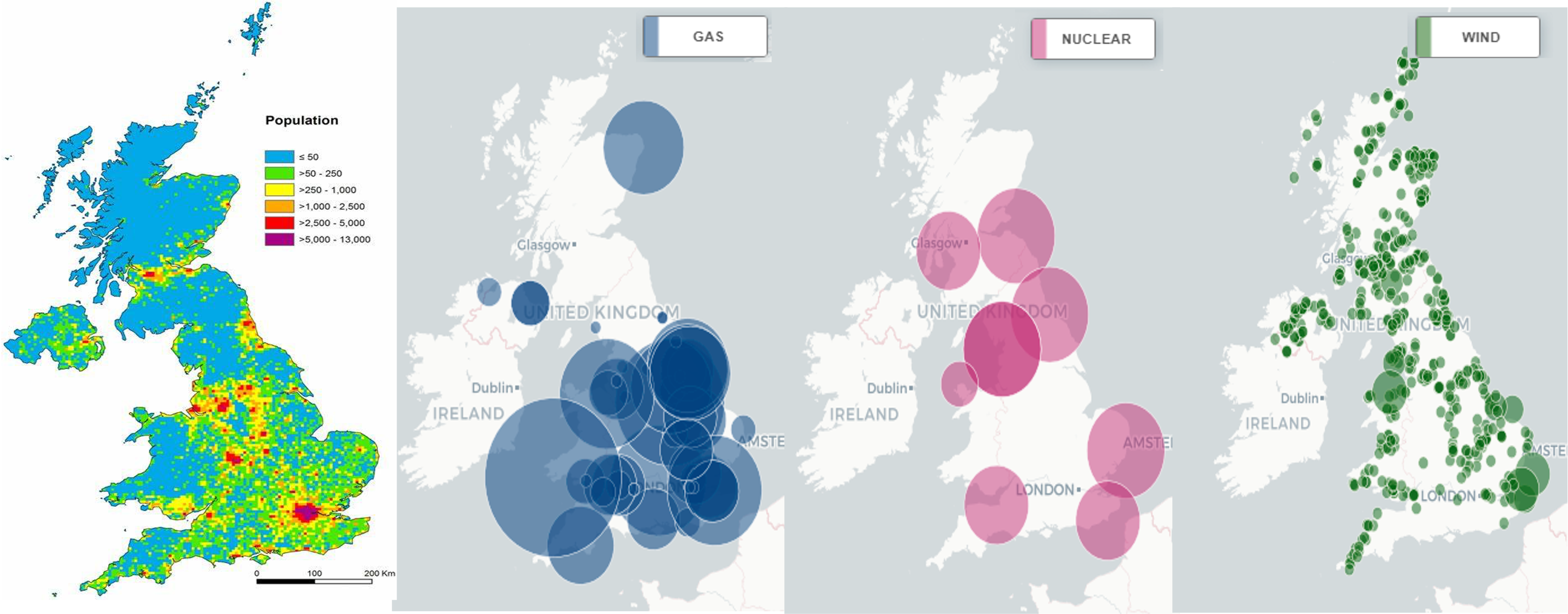

Although renewable electricity production is progressing well – particularly in offshore wind – there is now a mismatch between these sources of supply and the layout of the grid, which historically has been largely determined by the needs of fossil fuel generation. This was starkly illustrated by mapping shown at the seminar:

Power grid was built for fossil-fired generation

Population density vs. location of power generating assets

Sources: Vieno et al (2015), Carbon Brief

Michael Lock, Associate Director in Energy, Renewables and Infrastructure at Savills, suggested that with much of the grid infrastructure still dating from the 1930s and 40s, the UK is probably 10-15 years behind where it needs to be for the cabling needs of offshore wind. There are also problems with finding the space to build new distribution sub-stations in the highly developed areas where demand tends to be concentrated.

One of the most serious issues this has thrown up for real estate is the queuing regime that the electricity distributors have devised for connecting new developments to the grid. Lock described this as like waiting to be served at a coffee shop, with each customer dealt with in turn, even if they have problems paying and irrespective of their potential importance to the local economy. It is therefore essential for developers to apply for connection well in advance of completing the planning process, even if there are cost implications such as the risk of losing the connection deposit.

Lock also explained that the grid capacity available to a property can have a huge impact on its value, particularly for the most energy intensive assets. In one example, the availability of a 500kva rather than a 250kva connection effectively doubled the value of the property.

In the audience Q&A that followed the initial discussion, both of which were led by Lucy Greenwood of Savills, the panellists agreed that grid-related problems could be partially mitigated by onsite power generation, although Simpraga noted that there were technical limits on putting power back into the grid. Lock suggested that PV cells on roofs could work well in offsetting demands on external supply, but problems with battery storage still limited the potential benefits.

It was clear from the responses to many of the questions that grid-related issues are holding back the net zero transition, even if the UK’s position is not much more backward than other European nations. In one example Simpraga indicated that while air source heat pumps are now ‘fit-for-purpose’ for new residential developments, a relatively small number can breach the supply capacity in place; a similar situation often applies for charging electric vehicles domestically. Meanwhile, at the other end of the supply chain, Lock described how much of UK offshore wind capacity already constructed will not be able to come on-stream until after 2030 due to connection issues.

So what can be done to speed things up? Lock noted that the GLA tried to encourage some streamlining in the queuing system for around 40 projects last year, although this was an isolated case. However, he did imply that local authorities have an important role to play. Otherwise, potential growth in market segments such as life sciences may be curtailed, at least in the short term.

Tim Horsey